🏗️ Introduction

One of the first — and most critical — decisions for any entrepreneur is choosing the right business structure. In India, two of the most popular options are:

- Private Limited Company (Pvt Ltd)

- Limited Liability Partnership (LLP)

While both offer limited liability and separate legal identity, they differ significantly in compliance, taxation, scalability, and investor appeal. This blog will walk you through a comprehensive comparison of Private Limited vs LLP — with real-world examples, pros and cons, and a CA’s checklist to help you choose the right structure for your business goals.

⚖️ Key Definitions

- Private Limited Company (Pvt Ltd)

A corporate entity registered under the Companies Act, 2013. It limits liability of members and allows equity-based ownership. - Limited Liability Partnership (LLP)

A hybrid structure combining features of partnerships and companies, governed by the LLP Act, 2008. Partners have limited liability, but management remains flexible.

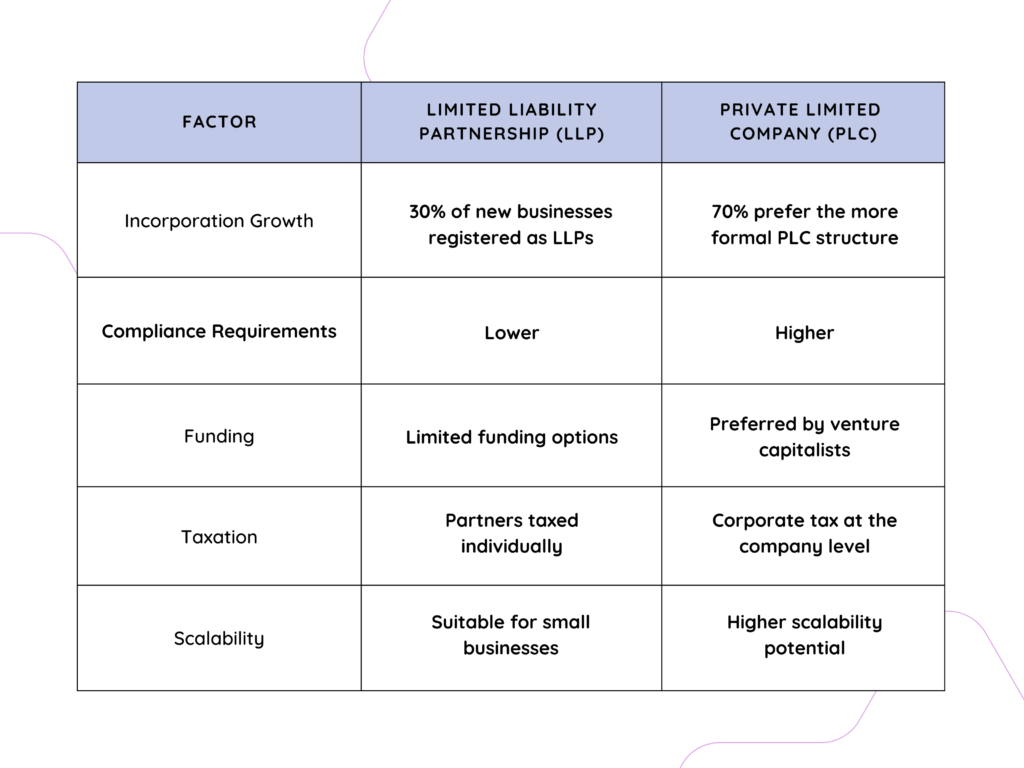

📊 Quick Comparison Table

| Feature | Private Limited Company | LLP |

|---|---|---|

| Legal Entity | Separate legal entity | Separate legal entity |

| Ownership | Shareholders | Partners |

| Governing Act | Companies Act, 2013 | LLP Act, 2008 |

| Registration Authority | MCA (ROC) | MCA (ROC) |

| Minimum Members | 2 shareholders, 2 directors | 2 designated partners |

| Annual Compliance Cost | ₹25K–₹50K | ₹10K–₹20K |

| Fundraising (VCs/Angels) | Preferred structure | Less preferred |

| Tax Rate | ~22% (plus surcharge) | ~30% (for income > ₹1 Cr) |

| Audit Requirement | Mandatory | Only if turnover > ₹40 Lakhs |

| FDI Acceptance | Allowed under auto route | Restricted in some sectors |

🔍 Key Differences Explained

1. Ownership & Equity Flexibility

- Pvt Ltd allows issuing of shares, ESOPs, and varying ownership percentages.

- LLP has partners, not shareholders, with limited scope for equity dilution.

✅ Choose Pvt Ltd if you plan to raise external funding or offer stock options to employees.

2. Compliance & Regulatory Burden

- Pvt Ltd companies must file annual returns, hold board meetings, maintain minutes, and follow detailed secretarial practices.

- LLPs have lower compliance — no mandatory board meetings, simplified annual filings.

✅ Choose LLP if you want to keep compliance costs and obligations minimal.

3. Funding & Investment Readiness

- Venture Capitalists and Angel Investors prefer Pvt Ltd companies, as they allow equity ownership and easy exits.

- LLPs are rarely funded unless converted to Pvt Ltd later.

✅ Choose Pvt Ltd if you’re building a scalable startup or plan to seek investment.

4. Taxation

- Pvt Ltd companies pay 22% (base) corporate tax under the new regime (plus cess and surcharge).

- LLPs pay 30% tax on profits (plus cess and surcharge).

✅ Pvt Ltd offers a more tax-efficient structure in many cases, especially when profits are reinvested or distributed as salaries/dividends strategically.

5. Audit Requirements

- Pvt Ltd companies must be audited annually regardless of turnover.

- LLPs need audit only if turnover exceeds ₹40 lakhs or capital exceeds ₹25 lakhs.

✅ LLP is ideal for small businesses in early stages that want to avoid mandatory audits.

6. Scalability & Expansion

- Pvt Ltd companies are easier to scale, open international subsidiaries, receive FDI, and launch IPOs.

- LLPs are generally best suited for professionals or service businesses (law firms, agencies, etc.).

✅ Choose Pvt Ltd if you plan to expand nationally or globally in the future.

📈 Real-World Examples

- LLP Use Case:

Two freelance developers start a software consulting agency. They opt for an LLP to enjoy limited liability and minimal compliance. - Pvt Ltd Use Case:

A tech startup building a SaaS product plans to raise seed funding. They register as a Pvt Ltd company to offer shares to investors and attract talent using ESOPs.

📋 A CA’s Checklist to Help You Choose

| Question | Recommendation |

|---|---|

| Will you raise external funding? | ✅ Choose Pvt Ltd |

| Are you starting with just 2–3 partners? | ✅ Choose LLP |

| Will you need to issue ESOPs or shares? | ✅ Choose Pvt Ltd |

| Do you want minimal yearly compliance? | ✅ Choose LLP |

| Is long-term scalability a priority? | ✅ Choose Pvt Ltd |

| Are you offering professional services? | ✅ Choose LLP |

| Will you work with international partners? | ✅ Choose Pvt Ltd |

⚠️ Common Mistakes to Avoid

- Starting as an LLP and switching later:

Converting to Pvt Ltd later involves legal and tax complexities. If you plan to scale, start with the right structure. - Underestimating compliance obligations of Pvt Ltd:

Don’t ignore MCA filings or ROC deadlines. It may lead to penalties or director disqualification. - Not consulting a CA during setup:

Your CA can help you make the right call based on your specific goals and ensure smooth registration.

✅ Final Thoughts

There’s no one-size-fits-all answer to the Pvt Ltd vs LLP debate. The right structure depends on your business model, growth plans, funding needs, and compliance appetite.

- If you’re running a professional service firm or small business, an LLP might be your best bet.

- If you’re building a scalable product, tech startup, or investment-ready venture, a Pvt Ltd is likely the smarter choice.

A Chartered Accountant can guide you through every step — from choosing the right structure to setting up compliance systems and filing with the Ministry of Corporate Affairs (MCA).

Start strong. Choose right. Grow smart.